Retiring in Cyprus: Planning Your Golden Years

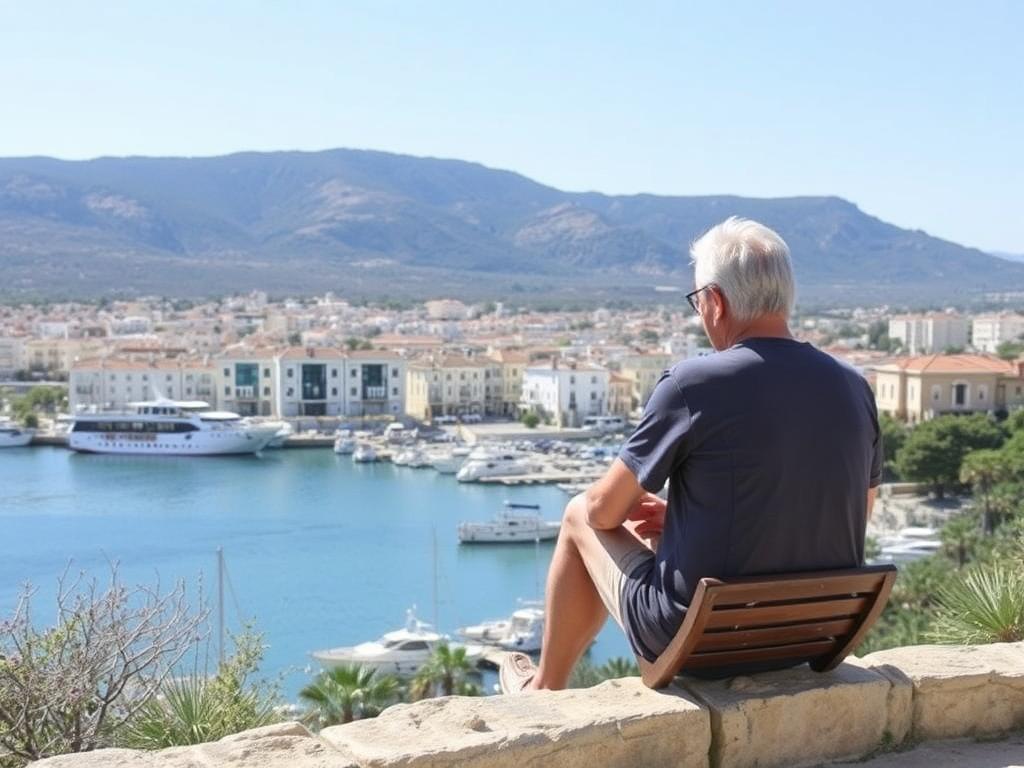

Choosing the ideal destination to retire is a complex decision that requires careful consideration of climate, cost of living, healthcare, and lifestyle options. For many retirees, the allure of a Mediterranean island with stunning coastlines, rich culture, and a warm climate makes Cyprus an increasingly popular choice. Retirement in Cyprus brings together a unique blend of modern conveniences and traditional charm, offering senior living Cyprus options that cater specifically to the needs and desires of older adults.

Whether you are considering pension planning Cyprus, navigating the complexities of a retirement visa Cyprus, or simply exploring the best ways to enjoy your golden years, this comprehensive guide will provide the clarity and insights you need to make an informed choice. We’ll delve into the practicalities of retirement, legal frameworks, lifestyle considerations, and the finer points of pension and financial planning to help you create a sustainable, fulfilling retirement experience on this beautiful island.

Why Choose Cyprus for Retirement?

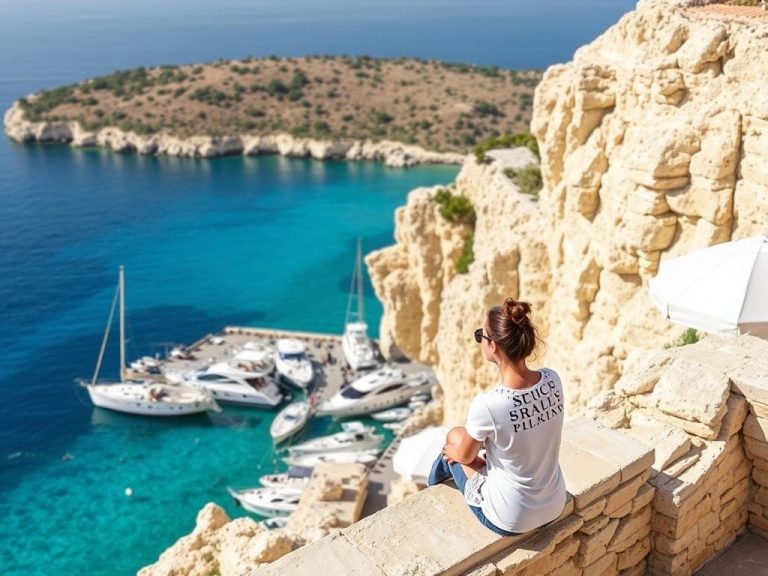

Cyprus is strategically located at the crossroads of Europe, Asia, and Africa. This Mediterranean island offers a combination of favorable weather, tax incentives, quality healthcare, and a relaxed pace of life that makes it an ideal playground for retirees. The island boasts over 300 days of sunshine a year, temperate winters, and accessible beaches, which appeal to those seeking to escape harsher climates.

In addition to the climate, the cost of living in Cyprus remains relatively affordable for Europeans and residents from many other regions. While property prices have risen steadily, they remain competitive compared to other Mediterranean countries popular among retirees, such as Spain and Italy.

Cyprus also enables a diverse expat community where English is widely spoken, reducing barriers for retirees who want to integrate but still communicate with ease. This international atmosphere is complemented by a strong cultural tradition and vibrant local cuisine, making everyday life in Cyprus both comfortable and enriching.

Cyprus combines ideal weather, affordability, and healthcare accessibility, making it a top contender for retiring abroad.

Navigating the Retirement Visa Cyprus Process

Securing a retirement visa Cyprus is a fundamental step for non-EU citizens looking to retire on the island. The Cyprus immigration system offers several visa options, but retirees most commonly seek residency through either permanent residence permits or the fast-track visa schemes designed for retirees meeting specific financial criteria.

The eligibility criteria typically include minimum income requirements, proof of pension or steady income, health insurance coverage, and sometimes a clean criminal record. This process often involves submitting documentation such as bank statements, proof of property ownership or rental agreements, and pension statements.

EU citizens enjoy simplified residency registration, benefiting from their freedom of movement rights within the European Union. For non-EU citizens, the retirement visa Cyprus process demands more stringent paperwork and approvals but is streamlined compared to many other countries.

Permanent residency options are also available for those wishing to maintain closer ties with the island without full citizenship, enabling retirees to live, travel, and enjoy benefits within the EU framework.

Understanding the retirement visa requirements early on can save time and provide peace of mind when relocating to Cyprus.

Planning Your Pension in Cyprus

Pension planning Cyprus involves understanding how your home country’s pension scheme interacts with Cyprus tax laws and retirement benefits. Cyprus offers enticing tax advantages for pension income, making it an attractive destination for retirees relying on foreign pensions.

The island’s tax framework allows certain pension incomes to be taxed at favorable rates or even exempt under specific conditions. Retirees benefit from treaties Cyprus holds with several countries to avoid double taxation. This reduces the complexity and ensures your pension goes further on the island.

Foreign pensioners moving to Cyprus must report their global income, but the overall tax rates remain competitive with considerable allowances. Moreover, Cyprus provides local pension schemes which those who worked in the country can tap into, either as supplementary income or a primary source after retirement.

| Type of Pension | Taxation Status in Cyprus | Notes |

|---|---|---|

| Foreign State Pensions | May be taxable or exempt depending on treaty | Double taxation treaties apply |

| Private Pensions | Generally taxable, some exemptions apply | Depends on source and residency status |

| Cyprus Social Insurance | Taxable as income | Accessible if contribution requirements met |

It is important for retirees to consult with financial advisors experienced in cross-border pension planning to optimize benefits, minimize tax burdens, and ensure steady cash flow throughout retirement.

Pension planning is essential to maximize income and avoid unexpected tax liabilities when retiring in Cyprus.

Senior Living Cyprus: Healthcare and Lifestyle Considerations

Healthcare quality is a critical factor for retirees when choosing a retirement destination. Cyprus offers a robust healthcare system combining public and private services. The healthcare infrastructure is modern and accessible, with English widely spoken among medical staff, crucial for expatriates.

The island has invested heavily in its hospitals, clinics, and specialized care centers, providing services ranging from routine checkups to more advanced medical treatments. Retirees on Cyprus can choose between the national healthcare system, which offers subsidized care, or private health insurance to access quicker and more varied medical services.

Beyond healthcare, senior living Cyprus means enjoying an active community with numerous opportunities for cultural engagement, outdoor activities, and social interaction. Retirement villages, condos, and independent living communities are well established, emphasizing security, convenience, and community support.

Many retirees are drawn to the island’s walking trails, golf courses, spas, and Mediterranean diet, contributing to overall well-being. Family-oriented social structures and festivals add a layer of cultural richness and connection that many seniors find deeply satisfying.

High-quality healthcare and vibrant community activities make Cyprus a fulfilling choice for senior living.

Cost of Living and Real Estate Market for Retirees

The cost of living in Cyprus is a decisive factor for many retirees. While no longer the cheapest Mediterranean destination, Cyprus provides excellent value for money considering the quality of life, climate, and safety. Essential goods, fresh food, utilities, and entertainment are generally affordable. Healthcare costs, especially with private insurance, are also competitive when compared to Western Europe and North America.

Real estate remains a primary consideration. The property market offers diverse choices, from beachfront apartments and luxury villas to countryside houses. The investment climate is relatively stable, and foreigners have the right to purchase property with ease, provided they meet certain conditions, including permits for non-EU buyers in some cases.

For retirees looking to rent, options are abundant. Rental prices vary substantially based on location, property type, and proximity to amenities. Many seniors prefer living near coastal towns such as Paphos, Limassol, or Larnaca, balancing accessibility and tranquility.

- Coastal properties tend to be more expensive but offer superior lifestyle amenities.

- Inland villages often provide a quieter, more traditional setting with lower costs.

- Newer residential developments focus on accessibility and community living for seniors.

Retirees should consider the physical demands of their chosen property, such as stair access and proximity to healthcare and shopping centers, to ensure a comfortable long-term stay.

Cost of living and property options in Cyprus offer flexibility, balancing quality and affordability for retirees.

Legal and Financial Planning Essentials

Retirement in Cyprus involves navigating legal requirements for residency, taxation, inheritance, and financial investments. Securing expert advice early is crucial to prevent legal pitfalls and ensure all documentation aligns with both Cyprus laws and those of your home country.

Tax planning includes understanding income tax, capital gains tax, and inheritance tax regulations, all of which affect retirees differently depending on their residency status and asset structure. Cyprus benefits from a relatively straightforward tax regime designed to attract foreign investment and retirees.

Estate planning is vital to protect assets and enable smooth transfer of wealth according to personal wishes. Cyprus has signed agreements with numerous countries to avoid inheritance disputes and double taxation on estates.

Financial instruments, including investment accounts, annuities, and savings plans, should be structured to accommodate Cyprus’ regulatory environment. Bank services and currency exchange policies also impact how retirees manage their funds.

Finally, awareness of consumer rights, legal protections, and dispute resolution mechanisms abroad helps retirees secure their property and investments with confidence.

Meticulous legal and financial planning lays the foundation for a secure and stress-free retirement in Cyprus.

Embracing the Culture and Lifestyle in Cyprus

Retiring is not just about logistics; it’s about creating a fulfilling life. Cyprus’ rich history and culture provide retirees with opportunities to engage in traditions, festivals, and community events that foster a sense of belonging. Whether participating in local church celebrations, enjoying music and dance, or exploring archaeological sites, retirees find ways to stay active and socially connected.

The island’s culinary scene, centered on fresh Mediterranean ingredients, encourages healthy eating habits and social dining experiences. Markets and local food producers offer a variety of fresh fruits, vegetables, cheeses, and seafood reflective of Cyprus’ bountiful regional offerings.

Outdoor living is a large part of the Cypriot experience. Retirees enjoy hiking in the Troodos Mountains, sailing along the coast, golfing, or simply relaxing on the island’s many beaches. The mild climate supports year-round outdoor activities, fostering physical and mental wellness.

Local communities are welcoming, with numerous clubs, volunteer groups, and expat associations facilitating integration and friendships across cultural lines. Learning basic Greek enriches this engagement but is not always essential due to widespread English proficiency.

Immersing yourself in Cyprus’s culture and outdoor lifestyle enriches the retirement experience beyond finances and logistics.

The Financial Track to Retirement in Cyprus: Step-by-Step

Transitioning to a successful retirement in Cyprus requires a structured financial approach that addresses income stability, taxation, property investment, and ongoing expenses. Here is a practical framework to consider:

- Assess Your Pension Income: Identify all income sources and understand how they will be affected by Cyprus residency.

- Consult Tax Experts: Engage advisors with expertise in Cyprus tax laws, pension planning Cyprus, and international treaties.

- Budget for Living Costs: Calculate expected expenses, including utilities, healthcare, transport, and leisure activities.

- Plan Property Acquisition: Evaluate property market data, location preferences, and legal requirements for foreign buyers.

- Secure Health Insurance: Choose comprehensive coverage suitable for senior living Cyprus scenarios.

- Organize Legal Documents: Prepare wills, powers of attorney, and residency permits in compliance with Cyprus law.

- Build Contingency Plans: Prepare for emergencies or healthcare escalations, including potential repatriation or long-term care.

Advancing through these steps methodically reduces uncertainty, prepares for unexpected costs, and ensures that retirement in Cyprus is financially sustainable.

Structured financial planning empowers retirees to enjoy Cyprus without worry about money or legal complications.

Unlocking the Best of Retirement in Cyprus

Retiring in Cyprus offers an intricate blend of natural beauty, cultural richness, and practical advantages that make it a prime choice for many global seniors. Successfully planning your retirement in Cyprus hinges on understanding the legal nuances of the retirement visa Cyprus, optimizing pension planning Cyprus, and embracing the island’s healthcare and lifestyle options.

This well-rounded approach ensures that your move to Cyprus isn’t just a relocation, but a transition to a vibrant, fulfilling phase of life. The combination of manageable living costs, excellent medical services, and a warm, welcoming community creates a solid foundation for enjoying your golden years.

Ultimately, early and detailed preparation will help you unlock the best retirement experience Cyprus has to offer. With the right financial, legal, and lifestyle strategies in place, you can look forward to a retirement enriched by sunshine, culture, and peace of mind.

Proper preparation transforms retirement in Cyprus from a dream to a rewarding reality filled with opportunity and security.

Frequently Asked Questions

- What is the minimum income required for a retirement visa Cyprus?

The minimum income varies but generally requires proof of a stable pension or income of about €10,000 to €15,000 annually, plus sufficient funds or accommodation arrangements.

- Can EU pensioners retire in Cyprus without a visa?

Yes, EU citizens have free movement rights and only need to register their residency upon arrival, without needing a specific retirement visa Cyprus.

- How is pension income taxed in Cyprus?

Pension income may be taxed at preferential rates or exempt based on bilateral agreements and the type of pension; consulting a tax expert is advisable.

- Is private health insurance necessary for retirees in Cyprus?

While public healthcare is accessible, many retirees opt for private health insurance for faster service and broader coverage options.

- Are there retirement communities available in Cyprus?

Yes, several retirement villages and senior living Cyprus facilities offer tailored services, security, and social activities for older adults.

- Can non-EU nationals buy property in Cyprus easily?

Non-EU nationals can purchase property but may require government permits depending on the property type and value; the process is generally straightforward with proper advice.

- What are the healthcare standards like for retirees in Cyprus?

Healthcare in Cyprus is high quality, with modern facilities and English-speaking professionals, making it suitable for retirees with ongoing medical needs.